Artificial intelligence (AI) has generated a great deal of excitement as a potential solution to complex modeling problems. One area where it has been explored is in the management of risks associated with derivative contracts in investment banking. However, despite the positive reports, there are concerns about the practical applicability of AI in this domain.

Challenges in Training AI Agents

A recent study published in The Journal of Finance and Data Science by researchers from Switzerland and the U.S. sought to investigate the use of reinforcement learning (RL) agents in hedging derivative contracts. The researchers discovered that training AI agents on simulated market data may yield favorable results only when the simulated market closely resembles the real market. Furthermore, the data consumption of many AI systems is often excessive, making them impractical for real-world implementation.

The Need for Accurate Training Data

One of the difficulties faced by researchers is the lack of training data. To overcome this limitation, researchers often rely on an accurate market simulator. However, choosing an appropriate simulation model and calibrating it correctly present significant challenges, akin to traditional financial engineering problems. This reliance on simulation models makes the AI-based approach analogous to the long-standing Monte Carlo methods utilized in the field for many years. Moreover, the scarcity of sufficient market data further complicates the training process, making it challenging to consider AI agents as model-free in the context of derivative markets.

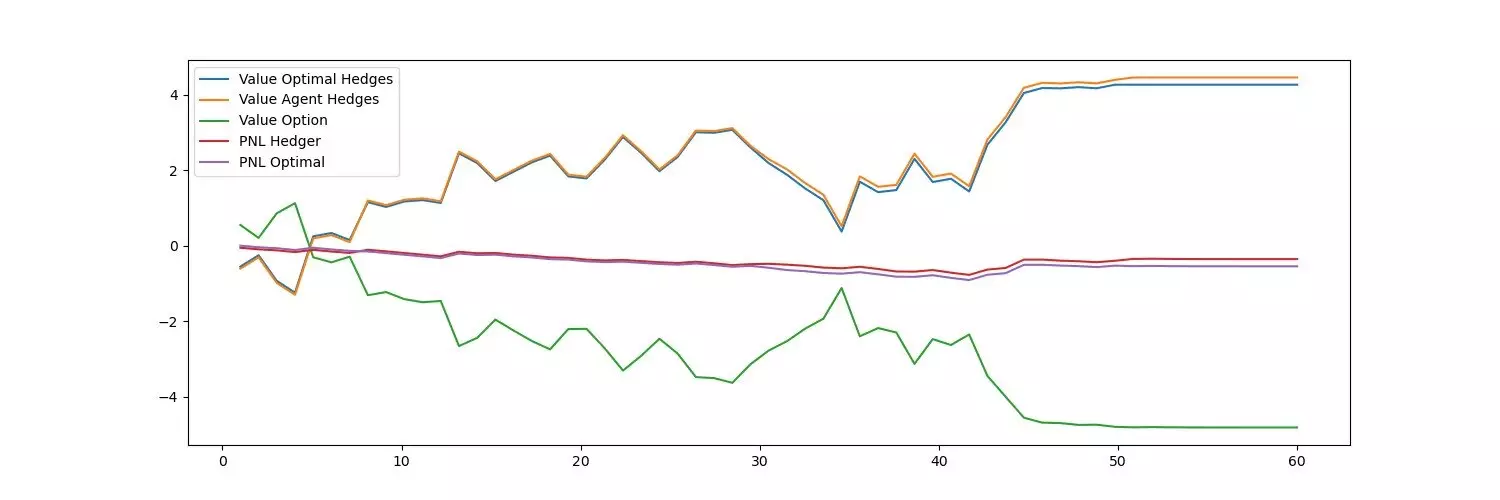

In the study, a collaboration between IDSIA and UBS investment bank, the researchers adopted the use of Deep Contextual Bandits. These algorithms are well-known in RL for their efficiency and robustness when it comes to data usage. Notably, this method takes into account operational realities faced by investment firms, including end-of-day reporting requirements. The advantage of the Deep Contextual Bandits approach lies in its lower training data requirement compared to traditional models, while still remaining adaptable to changing market conditions. This model closely mimics real-world business operations at an investment firm, giving it practical relevance.

While the newly developed method is relatively simple, rigorous assessments of its performance revealed its superiority over benchmark systems. The new approach demonstrated higher efficiency, adaptability, and accuracy under realistic conditions. This finding supports the notion that, at times, a simplified strategy can outperform more complex methods, showcasing the significance of risk management in practical applications.

The practical applicability of AI in the risk management of derivative contracts poses challenges. The study highlighted the importance of having accurate training data and the limitations of relying solely on simulated market data. However, the adoption of the Deep Contextual Bandits approach showed promise in overcoming these challenges. By considering operational realities and incorporating end-of-day reporting requirements, this method proved to be effective with a lower training data requirement. The study’s success demonstrates the potential of AI in improving risk management practices, albeit with the necessity of careful implementation and consideration of practical factors.

Leave a Reply