The collapse of FTX has sent shockwaves throughout the cryptocurrency community, shedding light on the imperative need for effective evaluation of the solvency of cryptocurrency exchanges. As one of the largest trading platforms for crypto-assets, FTX was valued at a staggering $32 billion before filing for insolvency unexpectedly in November 2022. This brought to the forefront the inherent risks and vulnerabilities associated with the crypto market. It is in response to these challenges that researchers from the Complexity Science Hub (CSH), in collaboration with the Financial Market Authority (FMA) and the Austrian National Bank (OeNB), have proposed a new approach to assessing the solvency of Virtual Asset Service Providers (VASPs).

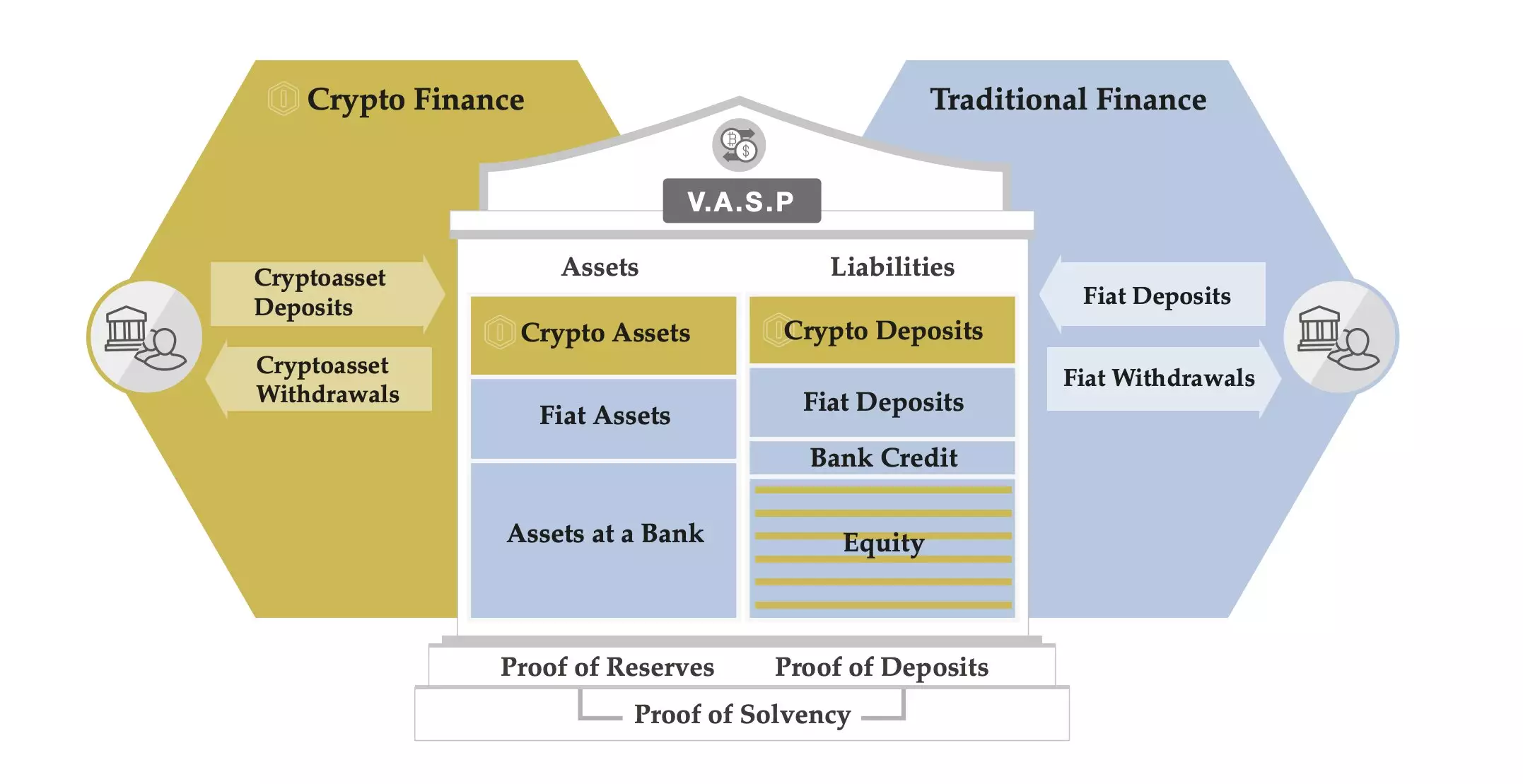

Traditional financial institutions adhere to established procedures when evaluating solvency. However, the same standards have not been effectively applied to the evaluation of VASPs operating in the cryptoasset sector. Unlike their traditional counterparts, VASPs operate on an ad-hoc basis, lacking a systematic approach to solvency assessment. This inconsistency is partly due to the fact that assets are held in pseudonymous wallets on various blockchains and are either undisclosed or only partially disclosed in available reports such as balance sheets.

The existence of publicly viewable transactions on blockchains like Bitcoin and Ethereum presents an opportunity to enhance solvency analysis and evaluation procedures. The researchers propose two key measures to address the current limitations. Firstly, VASPs should disclose their crypto asset wallet addresses and provide additional metadata describing the use of these wallets. This would enable independent auditors to assess whether a VASP truly has access to the funds associated with its on-chain wallets. Secondly, VASPs should separate their balance reports into crypto and fiat assets and report them at appropriate intervals.

To assess the feasibility of these measures, the researchers examined 24 VASPs registered with the Financial Market Authority in Austria. They compared three data sources: the VASP’s known crypto asset wallets, balance data from the trade register, and information from regulatory authorities. The findings revealed that the known crypto asset holdings were only partially consistent with the balance data. This inconsistency can be attributed to several factors. Firstly, not all VASPs separate their balance sheets for crypto and fiat assets, making it challenging to assess the proportion of assets from traditional currencies and crypto assets. Secondly, VASPs employ different strategies in managing their crypto asset transactions. Lastly, the crypto asset holdings of VASPs are currently not easily visible to third parties.

The collapse of FTX serves as a stark reminder that crypto companies can slide into insolvency, posing significant risks for their customers. It is paramount to develop robust solvency assessment methods for cryptocurrency exchanges to safeguard the interests of users. The proposed approach emphasizes transparency and accountability, enabling a comprehensive evaluation of VASP solvency. By implementing these measures, the crypto industry can take significant strides towards building trust and mitigating the risks associated with cryptocurrency exchanges.

The collapse of FTX has underscored the urgent need for enhanced solvency assessment methods for cryptocurrency exchanges. While traditional financial institutions have established procedures in place, the evaluation of VASP solvency in the cryptoasset sector has been ad-hoc and lacking a systematic approach. The proposed measures put forward by the Complexity Science Hub can address the current limitations and foster greater transparency and accountability. By implementing these measures, cryptocurrency exchanges can better protect the interests of their users and foster a more secure and trustworthy crypto ecosystem.

Leave a Reply